Well, it looks like we may have a debt ceiling “deal.” Can we all breathe a sigh of relief? The stock market will respond well today, so on the surface people will be happier. Everybody likes compromise, and this deal makes both sides unhappy, so that’s a great compromise, right?

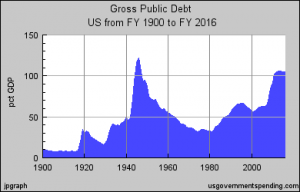

Well, if your idea of a compromise is getting herpes rather than AIDS, I guess that’s alright. Frankly, I’d prefer neither, and the graph at the top explains why.

Problem number one: the existing debt levels simply cannot continue. They are unprecedented (on a long-term basis) and will eventually lead to default on our debt because debt levels above 100 percent are not acceptable. In my post last week on this issue, I explained why: eventually, you can’t finance it anymore. All countries throughout history with debt levels above 100 percent eventually face an economic calamity.

This debt deal solves this, right? Aren’t we going to cut trillions?

Sorry, no.

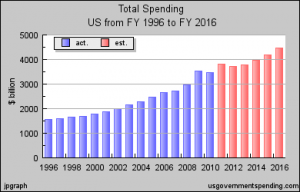

Problem number two: all of the plans under discussion increase spending overall. So, when you hear “$2.4 trillion in cuts” or whatever the number is these days, it is based on cuts over 10 years and is based on a baseline that is already growing. The baseline calls for $6 trillion in additional deficit spending over the next 10 years. So, cutting $2.4 trillion means the deficit will grow $3.6 trillion. Nothing significant will be cut except the rate of growth. So, the budget and deficit will still grow, but they will grow slightly slower.

Problem number three: today’s Congress cannot promise what futures Congresses can do, it can only promise what the budget will be in 2012. Whatever deal is struck this week is really only good for about a year. So, any figure of cuts “over 10 years” is completely meaningless. The only figure that matters is “cuts in 2012.” And what exactly are the cuts in 2012? Well, real cuts, meaning spending cuts where we spend less rather than slow the rate of growth, are expected to be about $22 billion. Yes, you read that right. Out of a budget of $3.8 trillion we are cutting $22 billion. This is pretty much akin to having a $50,000 credit card bill and celebrating because your telephone bill is going down from $40 a month to $30 a month.

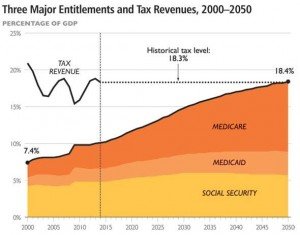

Problem number four: this deal does nothing to deal with entitlements. There are promises that a commission will look at it, but nothing firm. The entitlements are where the rubber meets the road.

As this chart shows, entitlements (Medicare, Social Security, Medicaid) are growing exponentially. The reason? The baby boom generation is about to retire. Again, this deal does nothing serious to change this long-term problem.

Problem number five: there are no serious cuts in military spending. All of the caterwauling from “conservatives” on military spending is pure bunk. Yes, by historical standards we are spending less on the military than we did in the 1960s (as a percent of GDP), but our economy has grown. The issue is: what is our long-term strategy? Why do we have hundreds of military bases around the world and why are we currently fighting in six different countries? As I said in my last post, Republicans missed an historic opportunity to “go big” by proposing big military cuts in exchange for truly cutting spending on entitlements and the massive welfare state.

Problem number six: the blame game. You will be hearing claims in the coming days about how government is too small, how the cuts will be hurting the poor (and hurting defense) and on and on. The point seems to be to score political points, and in this regard both sides are incredibly dishonest. Don’t pay any attention. This is a bipartisan problem caused by bipartisan spending on pet projects that are loved by both sides. The true long-term solution is changing our attitude toward what government should do. We need to go back to the concept of self-reliance and a small, humble government that is nearly invisible. We are a very long way from that, and the blame belongs to almost all of our politicians.

Great post, Geoff.

I have been arguing on FB that this is a shared problem between Democrats and Republicans, with each sharing the blame for the ballooning deficit and lack of a real, long-term solution to our deficit.

I love that we have a deal in place to avoid default, but I’m not happy that we are once again punting the issue off for another day.

This hasn’t passed any of the houses yet and I don’t see signs this will pass the House. The deal from what I have seen is once again the Bohner one that at first didn’t have the balanced budget amendment attached. I know that putting terrible legislation forward as if a new one by adding one or two minor changes until it passes is part of the game, but I am hoping not this time. My personal sticking point? Raising the ceiling at all is a big fat NO! I can’t do that and neither should Washington.

With regard to your last graph, it is important to note that although the line representing taxes represents “historical levels,” it is well above current levels, which your allies have deemed inviolable. If taxes do not increase to at least historical levels, the dreaded moment at which they do not even cover entitlements occurs 20 year earlier than your graph shows.

And to those who still oppose any increase in the debt ceiling, be careful what you wish for. If this deal doesn’t pass, Obama will invoke the 14th amendment and be rid of the debt ceiling forever. (And, yes, he will be impeached, but it will not matter because the Senate will not remove him.) The next Republican president will silently thank him.

LL, your first point on taxes is true, but the main reason taxes as a percent of GDP are so low is because the economy is weak. Taxes were lower in the late-1980s, and taxes as a percent of GDP were at the historical average. Economic growth, which is not happening in the Obama economy, solves a lot of ills.

These charts might be of interest when comparing spending and revenue.

http://www.businessinsider.com/heritage-foundation-budget-spending-deficit-2010-6#-19

As you can see, the only time we have had a balanced budget recently was during the late 1990s and 2000. There was a revenue increase during that period, but there was also a massive decrease in spending as a percent of GDP. A lot of that spending decrease was defense-related.

So, the prescription is clear: cut government, including defense.

Geoff – I agree economic growth solves a lot of ills. But we still haven’t paid for our growth in the last 20 years. How can we pay for more growth on top of that? I think the politicians realize this. If we want to do what seems right (ie. paying for our growth) we’ll have to be stagnant while we unburden ourselves from all this debt. That will not be a pretty situation for the economy, especially with our society that does not value work. Can you imagine people being asked to work and having little in the way of fun, toys, vacations, etc. to show for it because they are mostly working to pay off what they already consumed?

The nation debt is 14.5 trillion. But a lot of people don’t realize that private household debt is about the same (haven’t seen the latest numbers, but it was pretty much even a year ago). Now, I don’t want to be the scary person who is waving around “trillions” to shock people into doing something like those people who insist on pointing out that we have 114 trillion in unfunded liabilities (we do, but fortunately, we have many trillions in unpaid work and productivity to count on in the future as well).

But it’s important to realize that we have a nation have about 30 trillion in debt right now we have to account for. Not including another day of spending. And not including those future liabilities which our future work will have to pay for. I see no way that we can escape this debt without: inflation or confiscation. And heaven help us if we actually see deflation! That would effective increase our debt even if we spend less and start to pay it off.

I don’t see how this story ends well if left to our own devices. When you look at the household debt, mirroring the national debt, you can see we truly have the government we deserve. You can also see we don’t have a tax revenue or income problem, but we have an appetite for spending problem. Since this deal does not address that, but merely pretends to save a dime while spending a dollar, I repeat, we’re in trouble.

Chris, true. The only way to get real growth (not fake bubble-related growth) is by going through a year or two of market “clearing.” In the old days, that was a recession, which was considered a normal part of the business cycle when failing businesses were allowed to fail. If you allow failing businesses to fail (ahem, GM), you get better-directed investment on businesses that have a potential to grow (ahem, Apple). This leads to real growth, not the fake growth of recent years.

Most of that household debt (~$10 trillion) is mortgage debt, which is not a serious problem. We are not running up the federal debt to pay for fixed assets of lasting value like parks or highways, most of what we are doing with the federal debt is much more akin to consumer credit card debt (~3 trillion) – using it to fund present consumption.

In addition, this bill or something very much like it is almost certain to pass both houses of Congress with bipartisan support. A failure in either house would amount to a near unanimous Democratic vote of no confidence in the President and a near unanimous Republican vote of no confidence in the Speaker. That isn’t going to happen.

I tend to think this deal is a mostly a “we recognize the problem and we promise to deal with it seriously” sort of measure, but that is a big improvement over “problem? what problem?”.

Mark D. mortgage debt is not a serious problem? That was a very large contributing factor to the financial crises – depreciating asset value (the house) with a fixed overvalued liability (the mortgage) and the potential for adjusting interest rates on top of it.

“If this deal doesn’t pass, Obama will invoke the 14th amendment and be rid of the debt ceiling forever. (And, yes, he will be impeached, but it will not matter because the Senate will not remove him.) The next Republican president will silently thank him.”

In other words, you agree that Obama is a Tyrant and so is most of the GOP along with him and the Democratic Party? Just because something like this can happen, doesn’t mean I’m going to roll over and accept it without kicking and screaming.

LL, this whole 14th amendment canard is really a new low by the Dems like Clinton and Tom Harkin. Even Lawrence Tribe, no friend of Republicans, says it is not a way out for Obama.

http://www.nytimes.com/2011/07/08/opinion/08tribe.html

Key paragraphs:

“The Constitution grants only Congress — not the president — the power “to borrow money on the credit of the United States.” Nothing in the 14th Amendment or in any other constitutional provision suggests that the president may usurp legislative power to prevent a violation of the Constitution. Moreover, it is well established that the president’s power drops to what Justice Robert H. Jackson called its “lowest ebb” when exercised against the express will of Congress.

Worse, the argument that the president may do whatever is necessary to avoid default has no logical stopping point. In theory, Congress could pay debts not only by borrowing more money, but also by exercising its powers to impose taxes, to coin money or to sell federal property. If the president could usurp the congressional power to borrow, what would stop him from taking over all these other powers, as well?

So the arguments for ignoring the debt ceiling are unpersuasive. But even if they were persuasive, they would not resolve the crisis. Once the debt ceiling is breached, a legal cloud would hang over any newly issued bonds, because of the risk that the government might refuse to honor those debts as legitimate. This risk, in turn, would result in a steep increase in interest rates because investors would lose confidence — a fiscal disaster that would cost the nation tens of billions of dollars.”

In bizzarro land, Pres. Obama said the latest plan is good because it does not call for the “most vulnerable” to “shoulder the burden” of reducing our debt. It’s a strange world we live in, when asking someone to forego receiving payment for doing nothing is considered “shouldering a burden”.

Now, I’m not going to get anti-Obama here, as I think this is symptomatic across parties by and large. To tie in some previous posts on atonement… We have the Savior who is described through vivid imagery of making our burdens resulting from our own sins (or the sins of others against us) light and placing them upon his own shoulders contrasted with governmental imagery of shouldering burdens of those on the dole by not expecting them to pay their own way directly wherever possible.

I can’t remove my own burdens resulting from my own sins or the sins of others. But by and large, most people who are receiving government funds can get by pretty well if they receive less or none. We can save discussions for how we should handle situations in the truly needy and vulnerable who “can’t” for later…

To me at least, in many ways we really do seek to replace God with Government. For two thousand years, it was preached to look to God and through your faith and his grace let your burdens be made light. Thirty to Fifty years ago it was preached to look to the Government to make your burdens light. And now it’s gone one step farther and it’s preached that your burdens will be made heavy if you are actually expected to work for your daily needs.

Chris, all good points. If anybody thinks government is not doing enough to help “the poor,” they may want to look at this:

http://www.businessinsider.com/heritage-foundation-budget-spending-deficit-2010-6#-9

Does anybody really think there is nothing that can be cut there?

chris (#9), the total amount of mortgage debt is not a serious problem. The way that it is issued by the banks can be, if they do not properly take credit risks into consideration, do not require large enough down payments, lend at too low or variable interest rates, and so on.

One way or another everyone is going to have to pay for housing whether they take out a mortgage or not. The same does not apply to most of the stuff the government is borrowing money for. We could reduce the size of the federal government back to Clinton levels, and most people wouldn’t even notice – not directly anyway. The difference is mostly money down the drain – paying for endless superfluous and superficial programs that we don’t need, subsidizing waste and inefficiency of all types, and on and on.

One of the reasons I am not pessimistic about this particular deal is I figure that ultimately the bond market that will force us to cut spending, and in a much more serious manner. Unless the public consensus is for federal taxes to double, of course.

A good piece on our current situation:

http://www.redstate.com/dhorowitz3/2011/08/01/9-reasons-to-oppose-boehner-4-0-debt-deal/

Mark D, you are correct that eventually the bond market or economic collapse will force austerity. Nobody know when it will come — it could be later this year or it could be in six years. But the problem is that when lawmakers panic they usually make bad decisions. I’m not too optimistic based on past panics (ie, Hoover panicking in 1930, FDR panicking in 1933 and then again in 1939, Carter panicking constantly, Nixon panicking and imposing wage and price controls and then of course Bush and Obama and the failed stimulus, TARP, etc). I’d like to think panic will bring good decisions, but history shows me it doesn’t.

I would like to have a reasonably gradual phase in to a balanced budget – five years perhaps, but that isn’t likely unless Republicans control all three branches of government, and relatively conservative ones at that.

So instead we enact imaginary spending cuts where we end up with a national debt relative to GDP much larger than the one we have now. That is not going to happen.

I would be impressed, as Democrats go, if any would put out a plan they were willing to sign on to to have a balanced budget anytime in the next decade. I don’t how they are going to do that without getting behind a 15% VAT or NRST or something like that, which would probably be good for their interests in the long run, but political suicide for a decade or so.

If the Republicans do gain filibuster proof control of the government, I hope they are serious about spending cuts, because a VAT or NRST is exactly the sort of thing we would likely end up with in a real fiscal crisis, and unless they back down from the 50% of the population shouldn’t pay taxes position, something that we are almost certainly going to have either way.

Mark,

That kind of sounds like saying, the problem is not with mortgages, it’s just that so many of the mortgages are underwater. If mortgage debt was half of what it was, and we had all the current problems of no down payments, variable rates, etc. then the problem wouldn’t be so severe. Likewise, there would be absolutely no problem with variable rate loans or no downpayment loans if mortgage debt was 1/10 of what it is now. The amount of total mortgage debt also wouldn’t be a problem if it was divided by twice as many house holds as it is. But as it is now, the amount of mortgage debt we have, and the amount of assets we have to show for it is a real problem.

I agree with your observation that the problem will take care of itself so to speak once the bond market dries up. But by that point, we will be faced with a situation where it is either impossible or far too expensive to borrow in times of need and will still be faced with paying off a lot of prior debt. Easing ourselves out now, rather than going cold turkey with no future prospect of borrowing is a tough choice.

Chris, even as it stands today, the problem with outstanding mortgages is a tiny fraction of the problem we have with the national debt.

My point, however, is that $10 trillion in mortgage debt, properly structured, isn’t a problem, period, for the reason that the payments cover housing expenses that we would incur anyway – with or without a mortgage.

Running up the national debt to present levels might be foolish, but it wouldn’t be a serious problem either, if we didn’t incur any more for the next thirty years.

Mark – this just seems strange to me. If you want to evaluate the credit worthiness of a borrower, you will factor in the amount of current obligations. The fewer current obligations the better. That our current obligations are in all likely hood greater in value than the “real” value of the assets only compounds the problem.

You suggest that housing expenses would be incurred anyway. I submit to you that it is an abberation, and not standard historical practice in the US to have such a large house payment. I never suggested this was “the” (only) problem. But it’s certainly a large contributing factor that not only do we have XYZ obligations, but we also have ABC obligations. And I’ll suggest that if we did not have ABC obligations in addition to XYZ obligations, than XYZ wouldn’t be as great a problem.

I think the economy and the average American citizen would be better off, if all those people who are in ownership situations, where in either a house that was paid off, or in a house where the mortgage payment was 25-50% of what it is — whether that’s because of a lower principle resulting from higher down payments, smaller houses, less price inflation, etc.

It’s simply not the case that it’s normal and a good thing for the average consumer to be so completely tapped out and lacking in flexibilty. It’s simply not a good thing for an economy to have so many consumers tied down with debt obligations, compared to an economy where a consumer was not tied down with debt obligations. Even if that consumer was simply renting for the same price, they would be flexible enough to walk away. Now we have people on both sides of the country and in between waiting for their house to sell so they can seek out a better economic condition elsewhere. So even if we replaced the massive amount of 30year debt with monthly rent obligations, it would be better.

Chris, this whole mortgage thing is off topic, so perhaps we should drop it. My only claim is that $10 trillion of mortgage debt properly structured isn’t a problem.

Where you seem to keep arguing that that the current mortgage debt structure is a problem. I agree, it just doesn’t even come close to a $14 trillion dollar debt not secured by any real assets, that we are running up more than ten percent every single year.

We have a government guaranteed fractional reserve banking system, and so far it looks like we will be out what, $300 billion? That is about as much as the federal debt we incur every couple of months.

Anyone here think that tax increases have any place in balancing the budget and paying off the debt, like Reagan did 7 times in his presidency?

Try balancing the budget yourself in this nifty interactive:

http://www.nytimes.com/interactive/2010/11/13/weekinreview/deficits-graphic.html

You’ll soon find out that balancing the budget entirely on spending cuts would not only be a political impossibility, but would entail so many cuts that only the most radical libertarians would espouse them all.

But add a few modest revenue increases to the spending cuts, and a balanced budget is well within the realm of political and economic feasibility.

This was the political view of the bi-partisan Gang of Six, and went closer to balancing the budget than any other plan on the table, before it was sabotaged by the Tea Party.

Nate, I’ve gone through that NY Times exercise. Actually, it’s a bit misleading. The Gang of Six proposal balances the budget — maybe — in 25-30 years. Not exactly groundbreaking.

I am in favor of the Obama deficit commission’s proposal of lowering rates and getting rid of deductions, which would increase revenue in a common sense way.

Just for your information, there are several proposals out there to balance the budget in a shorter timeframe.

–Gary Johnson says he would balance the budget by 2014 with 43 percent cuts in every area.

–Ron Paul has a similar proposal and would concentrate on military spending cuts first.

–Rand Paul has a plan to balance the budget in five years.

–The Republican Study Committee has a plan to balance the budget in eight years.

Could you point me to an official proposal by any Democrat to balance the budget in any reasonable timeframe (say, less than 15 years)? As you may be able to tell, I favor huge cuts in military spending (unlike many Republicans), so I am open to reading these proposals.

Thanks Geoff for enlightening me on the various proposals, which I haven’t studied enough. I can’t point to an official proposal by a Democrat which balances the budget under 15 years.

Glad to hear that you favor big cuts in military spending and eliminating deductions. I would be interested to hear you comment on how these revenue increasing measures were all muscled out of the compromise, leaving us with proposal of only tepid spending cuts. The Tea Party would have been able to cut more of what they wanted to if they only had the flexibility to add a few revenue increases. That’s the nature of politics.

Is the point of Tea Party idealists to purposely promote gridlock through non-compromise, and then hope that the country will vote out all the democrats in congress and the white house, leaving them to institute their dramatic cuts unchallenged? Is that what they believe the only hope for the deficit is? Because that’s never going to happen. The Tea Party only account for, at most, a third of the country.

Politics is compromise.

We already have a tax increase scheduled for seventeen months from now, and I seriously doubt anyone is going to be postponing it this time.

There are some good aspects about the Bush/Obama tax cuts, but structurally speaking, they are a first class disaster, and I will be happy to see them go.

Republicans tend to be worried that if we raise taxes, we will be stuck with them. Maybe so, but the upside is that if we raise taxes to match something resembling actual spending there will be heavy political pressure to cut spending enough so we can lower them to historical levels again.

Where right now, the public has been lulled into a false sense of security where they think they are going to get traditional Social Security, Medicare, and federal services for next to nothing. If you aren’t paying fifteen percent of your income to the federal government, your taxes are almost certainly going to go up, even if we cut most spending back to Clinton levels.

All that is why I would be delighted to have a balanced budget amendment, spending cap or no spending cap. There is a natural dynamic here that shouldn’t be ignored.