Saving money was the topic of our ward’s last 5th Sunday discussion.

Saving money was the topic of our ward’s last 5th Sunday discussion.

Fun as it was to come up with a perpetual planner, that was a mere lark compared to the really cool tool I worked on during the holiday break. The problem was developing a template to plan and manage family finances and scheduling.

Just like there are lots of tools for performing tactical management of money, I was looking for something that would help us get a strategic approach to money. To some people this comes naturally. To many couples, this is no big deal. Some families already have systems to live well within their means.

We, on the other hand, find the financial aspect of life to be somewhat of a challenge, in part because we have lacked a tool that helped us have a common understanding of our spending and obligations.

A few years ago I had set things up so the bills would get paid with a minimal amount of effort on the part of my husband and myself. The holy grail was a tool that would help us easily visualize the year’s finances in advance so it would be easy to stay on budget even when the bank account showed lots of money “just sitting there.”

Simple Budget

My detour into creating a financial plan started with looking for a budget page. When you open newer versions of Excel, you can search for something someone else has already created. I liked the looks if the one titled “simple monthly budget.”

Within a few minutes I had updated the categories to things that made sense to me and entered roughly what I thought we were spending in each category. But establishing a budget is all the original file was set up to do. I might as well scrawl the budget in crayon on a piece of paper, fold it into a plane, and throw it out the window for al the good it would help us communicate and understand between one another.

Adding Monthly Details

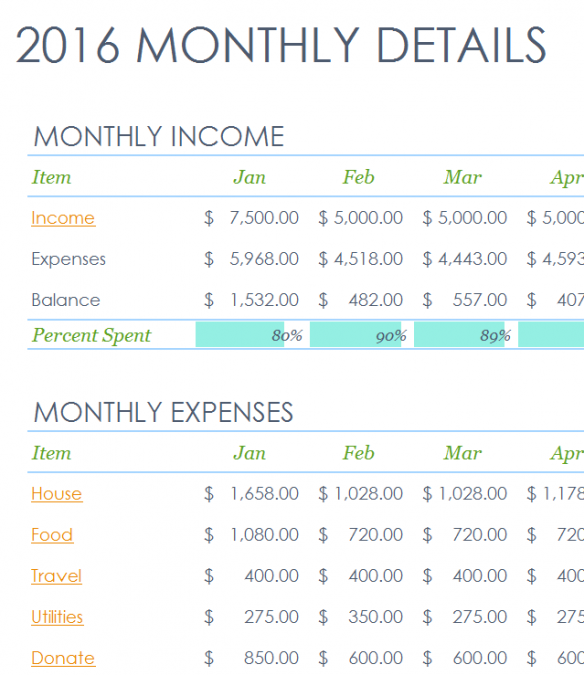

A first step was to add a page for monthly actuals. This would let me track what happens in each month. Since I get paid every two weeks and pay my mortgage bi-weekly, the typical monthly budgeting approach is a bit of an odd fit, with 2-3 months of the year being 50% “bigger” than normal.

This page gives a snapshot of how much of each month’s income is committed, shown both as a text percentage and the size of the bar in each month.

For each category, I created a page for the details of that category, which is hyperlinked to the monthly summary page.

![]()

Status (grey)

![]()

The three status tabs provide awareness of what you plan to have happen with your finances for the year

- Budget is a static page which the other pages reference, where you specify what your average monthly budget will be for the year.

- Worth is a relatively static page linked to your credit and savings pages where you can maintain a snapshot of your major assets and liabilities.

- 2016 shows the monthly summary of all your income and spending, with hyperlinks to the detail page for each category of spending.

Getting Paid (green)

![]()

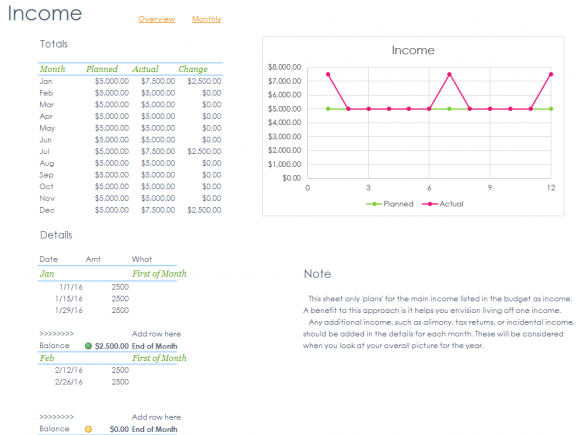

These two tabs show money you are either paid by others or money you pay to your future self in the form of savings.

- Income includes net earnings from your job, social security income, second incomes, alimony, dog sitting, yard sales, etc.

- Save shows the amount you are paying towards your future. Since I pay into my retirement before I get my income, I only show contributions to short-term savings, leaving long-term savings to be reported in the “Worth” tab.

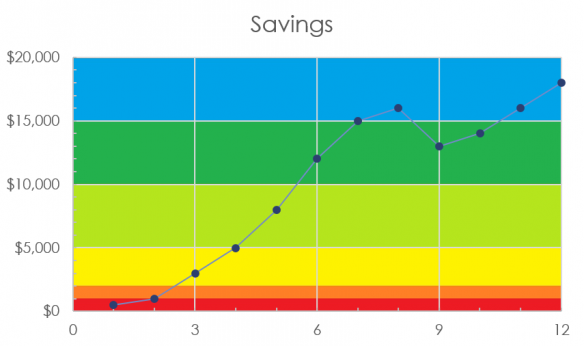

The Savings tab has an extra chart that allows you to track your short-term savings balance. Using the Dave Ramsey Baby Steps to financial peace, the first thing is to get $1000 in savings. After that, you want to work toward accumulating a 3-6 month savings reserve, as shown in the initial figure in this post.

Regular Payments from Checking (purple)

![]()

These five tabs are for things that are relatively predictable and that are appropriately paid from a checking account.

- Donations includes all giving, including tithing, money for the local high school club, etc.

- House is for all things related to paying for the structure in which you live or house your stuff: rent, mortgage, storage unit, insurance, and community fees.

- Utilities is for Water, Electricity, Internet, Phone.

- Learn is for educational expenses, including saving for future education (such as a 529 plan).

- Credit is for tracking and paying down credit card debt.

The credit tab has more information than the other expense tabs, since you probably want to be aware of interest rates, total balance, etc. I’ve got the credit page set up as though you are planning to pay down your credit using the snowball method, so once you enter the details for January, the information for the rest of the months automatically gets calculated. You would update this with actuals as the months progress, with future months still being pre-calculated based on the history you enter manually.

In this case, the graph shows the amount committed to paying these current credit debts. As the line for actuals begins to drop, you see where you “budget” for paying off credit can now let you reallocate that money to paying additional on the remaining credit debt. This is the “snowball” effect folks like Dave Ramsey talk about, that your ability to pay your debts snowballs as you pay off low-balance credit and keep your total debt payment budget constant. This is the difference felt by people who pay off their good credit loans, bad credit loans are a whole other experience, what is a bad credit loan? Loans that people should not of been approved for and now are dragging them under. This destroys their credit scores and other reputations.This page also includes a chart for recording your FICO score, so you can see if it is improving (or not).

Cash Envelope Expenses (blue, gold)

These are expense categories for which people often use the cash envelope system.

![]()

In the case of our family, we are planning to use credit cards to make payments for Travel, Clothes and Electronics payments, in part so that we can keep using credit to improving the credit score. The other issue is that some Travel expenses (gas, rental cars) can do terrible things to debit cards, with “holds” that tie up available funds for days after completion of the purchase itself. With Clothes and Electronics, purchases can be highly variable, even when within the annual budget.

For Food, Home, Health, and Fun, a traditional cash envelope system works great. The idea is that you allocate a certain amount for each period of time (month, week, etc.) and when the money is gone, you stop spending.

The great thing is that as you hold yourself to your budget, you are teaching your children and other loved ones this important principle, as concisely summarized by this child:

Since not all of us are single parents, it’s brilliant that banks have now come up with prepaid cards where two adults can have a card that accesses a reloadable joint cash account. My bank (Navy Federal) will let you set up five different such cash accounts, and there is an app so each adult can view purchases and the remaining balance.

Seeing the Whole Year’s Spending in Advance

The power of seeing the whole year of having a normal life in advance is that you can forecast the amount you could put towards savings, either for peace of mind, paying your future self, or for serving others.

Below is the budget spreadsheet set up for a fictional family. I inserted $23,000 of consumer debt across 10 accounts – hopefully that is more than enough to cover what anyone downloading this file has to worry about.

If you have any suggestions or improvements, feel free to let me know.

New Post: Tools for a Happy 2016 – Money Management: Saving money was the topic of our ward’s las… https://t.co/xHZrNLxaug #LDS #Mormon

TheMillennialStar: Tools for a Happy 2016 – Money Management https://t.co/l7CaUZ2Lq3 #lds #mormon

RT @Millennialstar: New Post: Tools for a Happy 2016 – Money Management: Saving money was the topic of our ward’s las… https://t.co/xHZrN…